Commercial lenders – Who are they lending to and which business sectors are they avoiding

9th October 2023

By Alex Walker

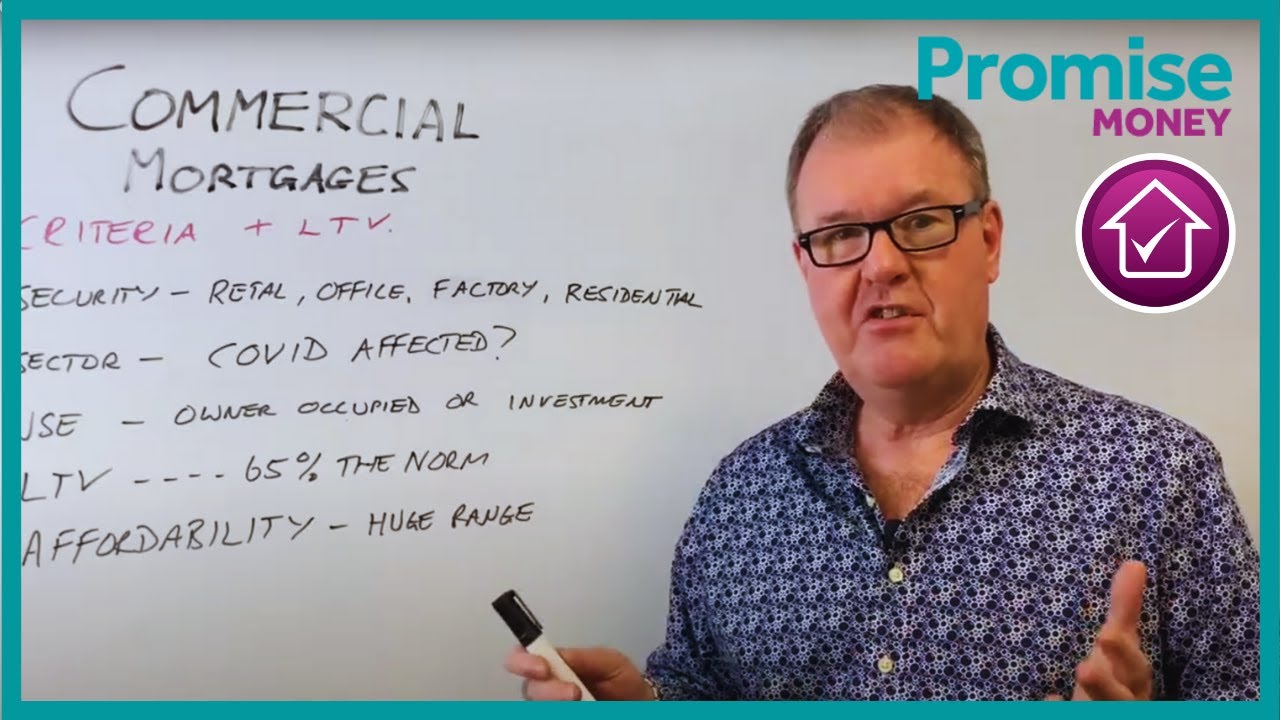

Commercial lenders in 2021 – please watch the video or read the video transcription

This is an overview of how commercial lenders are approaching the market at the start of 2021. It should give you a feel for what’s going on in the market. We’re in the middle of lockdown still, and lenders have all reacted differently. So let me just explain with some real life scenarios of how things are at the moment.

So the pillars of any deal are security, the sector, the use, the LTV, and affordability. Affordability is a really big one at the moment. I’ll come to that in a moment. But a major factor for commercial lending, especially high street lenders, are their policy decisions. They’re saying we do like that type of security or we don’t, and if they don’t it doesn’t matter how good the deal. It doesn’t matter how good the affordability, the LTV is, policy decision makers are saying no. We’re not going near that sector or near that type of security.

Market sector

Commercial lenders are nervous about offices at the moment because more people are going to be working from home. They are worried about retail because what’s of going to happen on the high street. For factories well you’ll probably be okay, but they’ve got to look at the whole deal. As for residential, that’s not too bad either.

The first thing commercial lenders are going to look at is, has that sector been affected by COVID? If so, they’re not going to be very very keen at all.

To give you an example, I was talking to one lender and they said the only sector they were really interested in is logistics and storage, i.e they are supporting the online retail market but they’re doing nothing in the high street, nothing in offices, nothing anywhere else, that’s all they’re really interested in. So that’s fine. We just need to know that they won’t do the other areas.

Investment or trading business

Another factor, is whether it an owner-occupied application or is it an investment property. Again, strangely, we’ve got some lenders saying “yes we’re happy to do owner-occupied applications but we’re not going to go anywhere near investment at all”. Then we have other lenders saying “no – we’re not going anywhere near owner-occupied we’re only going to look at investment properties”.

So what it does mean? There are lenders out there and the rates are still good, but you just have to know where to go. When we ask brokers “how much is your client looking to raise?” the answer is often “the maximum”.

Loan to Value

Whilst borrowers may have in mind 75% loan to value, in virtually every case that doesn’t really exist now. I would say 65% is the norm. There are some high street lenders I know, that really are looking for 50% LTV .

Having said that, I’ve got a case that’s just going to offer now on a convenience store. They like the security because it’s a convenient store and its been busy sector. But, the purchaser has never run a convenience store before so in terms of experience that wasn’t great. However, the lender has offered 70% LTV on bricks and mortar, and 50% of the goodwill value of the business. So its difficult to predict.

We suggest brokers work on 65% LTV being the norm and we’ll try to get it higher if we can depending on the whole case.

Affordability and serviceability

Affordability is where we get the massive range of approach by lenders. I’ll try to explain and illustrate how massive that range is.

High street commercial lenders

If we take a £500,000 commercial mortgage as an example and let’s say it’s at a rate of 3.5% which is mid-range for the high street lenders at the moment.

And let’s say this person wants to borrow over 20 years on a capital repayment mortgage.

That is going to cost them around about £2,850 a month which is £35,000 per annum.

So your client’s might feel it’s a cost of £35,000 a year and their accounts are showing a profit of £50,000, so what’s the problem? Well it is a problem for most lenders.

To give you an idea, if we were to take application to a high street lenders (they all vary) but they’d probably stress the rate at 7.5% over a 20-year term – so the stressed repayment is closer to £48,000.

Then we’ve got the coverage ratio to worry about. On a buy to let you might be looking at 125% or 140%. However, a lot of the high street lenders are now requiring a 200% coverage and actually need the profit or rental income to be £96000 – even though the repayments are £35000. One lender is working on 300% so that’s £144 000 coverage to grant a loan costing £35 000.

Many businesses are failing to show sufficient profit or rental yield, especially when times are tough at the moment.

Tier 2 / specialist commercial lenders

By comparison, some of the specialist lenders will consider £500,000 and stress it at 5% and require 125% coverage. That gives us a stressed repayment of £25,000 and with 125% coverage an income requirement of £31,250 to service the loan on an interest only basis. And the good news is they will consider interest only.

So a Tier 2 specialist lender may accept the case with an income / rental of £31,250 whereas a high street lender may be looking for an income approaching £96,000 – in some cases higher.

What’s more, some of the specialist lenders will accept most forms of investment property where main stream lenders mostly won’t.

Its easy to see why some specialist lenders are so busy.

Summing up

The key message here is there’s a massive variation between high street and specialist lenders. They all have got different policies so your client could be an outright “no” for some high street lenders and might be a definite “yes” for another. I have an example on my desk right now where three lenders said no and one said we love it all day long and came back at a rate of 3.3%. So expect massive variation in appetite.

Once we get into the affordability issues then often we are looking more at the specialist sector and possibly considering interest only. So line your clients up to be thinking 65% LTV maybe 70% LTV. Regarding affordability it all depends on their accounts and recent management information but we have the interest only option and some specialists where we can get a positive affordability assessment more easily.

From mainstream lenders expect rates from just under 3% to just over 4%. However in the specialist sector you’ve really got to be budgeting 5% to 6 % – maybe slightly over 6%.

To dispel a myth, one broker said he had heard that commercial lenders are only doing loans of £500,000 upwards. Well some are but we have plenty of high street lenders accepting applications of £100,000 or less so don’t worry about it too much.

Interest rates are still good. It’s all about us finding the right lender for the right case.

Promise Money are members of FIBA

Talk to a Promise Money adviser for more details

New BTL Loan

Commercial Mortgages – rates and terms Feb 2022 intermediary

Help to Buy – Previously Owned Properties

Development finance explained

Promise Money is a broker not a lender. Therefore we offer lenders representing the whole of market for mortgages, secured loans, bridging finance, commercial mortgages and development finance. These loans are secured on property and subject to the borrowers status. We may receive commissions that will vary depending on the lender, product, or other permissable factors. The nature of any commission will be confirmed to you before you proceed.

More than 50% of borrowers receive offers better than our representative examples

The %APR rate you will be offered is dependent on your personal circumstances.

Mortgages and Remortgages

Representative example

Borrow £270,000 over 300 months at 7.1% APRC representative at a fixed rate of 4.79% for 60 months at £1,539.39 per month and thereafter 240 instalments of £2050.55 at 8.49% or the lender’s current variable rate at the time. The total charge for credit is £317,807.66 which includes £2,500 advice / processing fees and £125 application fee. Total repayable £587,807.66

Secured / Second Charge Loans

Representative example

Borrow £62,000 over 180 months at 9.9% APRC representative at a fixed rate of 7.85% for 60 months at £622.09 per month and thereafter 120 instalments of £667.54 at 9.49% or the lender’s current variable rate at the time. The total charge for credit is £55,730.20 which includes £2,660 advice / processing fees and £125 application fee. Total repayable £117,730.20

Unsecured Loans

Representative example

Annual Interest Rate (fixed) is 49.7% p.a. with a Representative 49.7% APR, based on borrowing £5,000 and repaying this over 36 monthly repayments. Monthly repayment is £243.57 with a total amount repayable of £8,768.52 which includes the total interest repayable of £3,768.52.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME

REPAYING YOUR DEBTS OVER A LONGER PERIOD CAN REDUCE YOUR PAYMENTS BUT COULD INCREASE THE TOTAL INTEREST YOU PAY. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

Promise Money is a trading style of Promise Solutions Ltd – Company number 04822774Promise Solutions, Fullard House, Neachells Lane, Wolverhampton, WV11 3QG

Authorised and regulated by the Financial Conduct Authority – Number 681423The Financial Conduct Authority does not regulate some forms of commercial / buy-to-let mortgages

Website www.promisemoney.co.uk