Good and bad with Bridging Loans

Good and bad with Bridging Loans

Bridging loans are most definitely a good short term option used to facilitate something else happening. They are mainly used to raise short term capital quickly, when it is not available through conventional borrowing.

Bridging is not the cheapest method of borrowing, so people thinking of bridging should have something to gain by doing so. If buying something to make a profit, bridging can be a good option. But remember to factor in the cost of funds in to your profit figures.

New to bridging? Learn the basics fast with these explainer videos

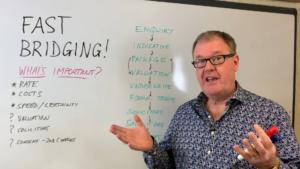

Features people like about bridging loans include:

- Specialist lenders are generally geared up to complete applications faster than mainstream lenders. Find out more about how fast bridging finance can be completed here.

- The proposed monthly payments can be added to the loan so they don’t need to be made monthly. This aids cash flow or helps borrowers who can’t afford the additional cost of a bridging loan.

- Lenders may be more flexible about the property condition – good for refurbishments.

- If buying at auction the loan can be agreed before you buy.

- If you have arrears or bad credit, lenders are more relaxed. This is because the loan repayments are built in to the loan.

- Lenders are more open to using a number of properties as security.

The general rule is that if you have plenty of equity, a definite means of repaying the loan quickly and offer suitable security it is likely you can get a bridging loan. However, that doesn’t mean it is the best solution so you speak to an expert about the alternatives.

Things you may not like about bridging loans…

If you are thinking about a bridging loan, ask yourself why you need the money now.

- It may be you need to complete quickly to make a large profit on a business deal.

- It may be that you need to repay something quickly and there are serious repercussions if you don’t.

- You may have your heart set on buying a dream home.

Whatever the reason, make sure you factor in the costs of bridging in to the equation. Bridging is short term borrowing so whatever fees and interest you pay, needs to stack up against the benefit of the deal or purchase you are contemplating.

Points to consider when weighing up the pro’s and con’s:

- It is short term borrowing – do you definitely have a plan and the means to repay the loan at the end of the term?

- The interest rates and fees are nearly always higher than mainstream unsecured, mortgage or second charge lenders – have you exhausted these options?

- Have you considered the default interest rates if you can’t repay the loan when it’s due?

- If your interest payments have been added to the loan, you are paying interest on this too and it will form part of the total loan amount you borrow.

- Do you understand the total cost of the facility and have you weighed this up against your proposed project or loan purpose? Does it still make sense?

You can get indicative rates and repayments without submitting a full application – jusk to speak to one of our experts.

Promise Money is a broker not a lender. Therefore we offer lenders representing the whole of market for mortgages, secured loans, bridging finance, commercial mortgages and development finance. These loans are secured on property and subject to the borrowers status.

More than 50% of borrowers receive offers better than our representative examples

The %APR rate you will be offered is dependent on your personal circumstances.

Mortgages and Remortgages

Representative example

Borrow £270,000 over 300 months at 7.1% APRC representative at a fixed rate of 4.79% for 60 months at £1,539.39 per month and thereafter 240 instalments of £2050.55 at 8.49% or the lender’s current variable rate at the time. The total charge for credit is £317,807.66 which includes £2,500 advice / processing fees and £125 application fee. Total repayable £587,807.66

Secured / Second Charge Loans

Representative example

Borrow £62,000 over 180 months at 9.9% APRC representative at a fixed rate of 7.85% for 60 months at £622.09 per month and thereafter 120 instalments of £667.54 at 9.49% or the lender’s current variable rate at the time. The total charge for credit is £55,730.20 which includes £2,660 advice / processing fees and £125 application fee. Total repayable £117,730.20

Unsecured Loans

Representative example

Annual Interest Rate (fixed) is 49.7% p.a. with a Representative 49.7% APR, based on borrowing £5,000 and repaying this over 36 monthly repayments. Monthly repayment is £243.57 with a total amount repayable of £8,768.52 which includes the total interest repayable of £3,768.52.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME

REPAYING YOUR DEBTS OVER A LONGER PERIOD CAN REDUCE YOUR PAYMENTS BUT COULD INCREASE THE TOTAL INTEREST YOU PAY. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

Promise Money is a trading style of Promise Solutions Ltd – Company number 04822774Promise Solutions, Fullard House, Neachells Lane, Wolverhampton, WV11 3QG

Authorised and regulated by the Financial Conduct Authority – Number 681423The Financial Conduct Authority does not regulate some forms of commercial / buy-to-let mortgages

Website www.promisemoney.co.uk